The Big Bet on Artificial Intelligence

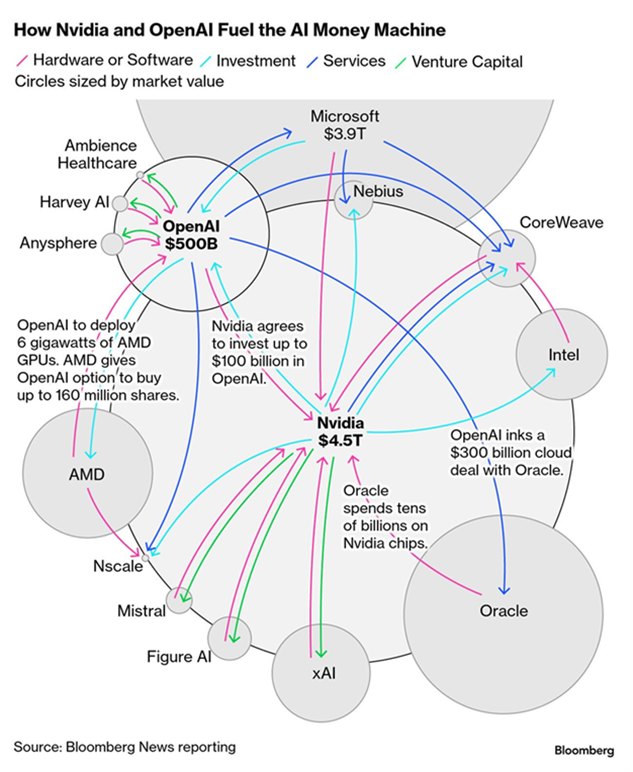

Big Tech’s aggressive debt push to fund artificial intelligence (AI) data centers is sparking credit jitters with rising default insurance costs and negative cash flows. All of North America (and China) appears to be placing a bold bet on future revenues driven by AI that could either soar, or strain if execution falters.

The cumulative amount of money spent on capital expenditures (CapEx) for AI infrastructure is estimated at $1.3-1.5T USD. That T stands for trillion! The amount of spending on this buildout in 2025 alone is astronomical (not hyperbole) – coming in at over $640 billion. For context, the entire Canadian public equity market is valued at $3.5T USD.

Some critics suggest that the hype around AI is similar to the hype around the internet and its initial build-out and uptake back in the late nineties. AI promoters will point to the fact that unlike the companies of the dotcom Bubble, the titans of AI are all highly profitable tech companies. At least they have been until 2025.

Total AI data center borrowing is now up to $126B. That amounts to a 500% jump in one year. To put that in perspective from 2015 to 2025 the entire tech sector averaged just $32B in borrowing. There are cracks beginning to form in the confidence levels of the credit market as these vast amounts are borrowed to fund this buildout. In recent weeks, the cost to of insurance to protect against a debt default (a credit default swap or CDS) on the outstanding debt of AI darling Oracle has spiked. Bond investors also want higher compensation to take the risk of lending money to Oracle. Why? Oracle’s spending has led to its free cash flow turning negative and debt levels are growing.

These profitable companies were funding their AI buildouts in a prudent way – with a portion of profits. Oracle is burning capital on data center buildouts faster than it can generate cash to pay for it. Leverage is increasing, and cash flows are dwindling. Circular financing structures (prevalent during the dotcom bubble) are appearing again.

What AI (nay, the debt and stock markets) needs is a sign that the monetization of their expensive platforms is underway. Analysts are expecting that to justify this CapEx explosion, the industry needs to see a revenue bump of over $1T by 2027, less than 2 years away. Where are we right now? Revenues are estimated at less than $300B.

A JP Morgan report estimated that AI investments will require $650 billion in perpetual annual revenue to yield a 10% return on projected AI CapEx through 2030. A staggering number, equivalent to 0.58% of global Gross Domestic Product – the total global economy. At the current trajectory, total data center investments could reach $5 trillion over five years, putting pressure on capital markets. This quote from that report hit home, putting that $650 billion into context:

“that equates to $34.72/month for every iPhone user on earth"- JPM

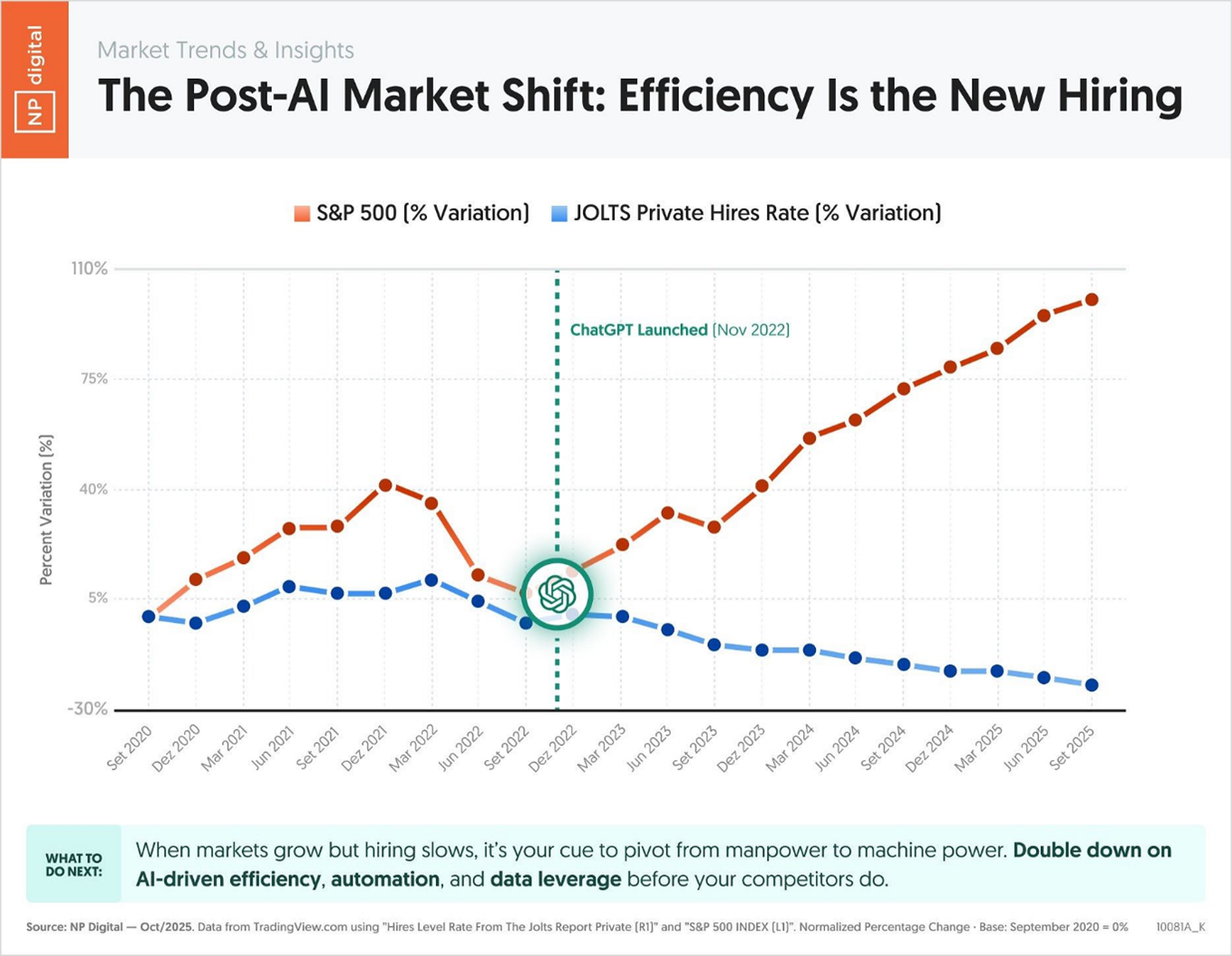

So what happens next? Will we see revenue growth with greater monetization of AI across the big tech names? Or will we see cost savings across all industries? Some analysts are suggesting that for those holding their breath for higher revenues may be surprised that the “$1T by 2027” comes in the form of cost savings (read: layoffs).

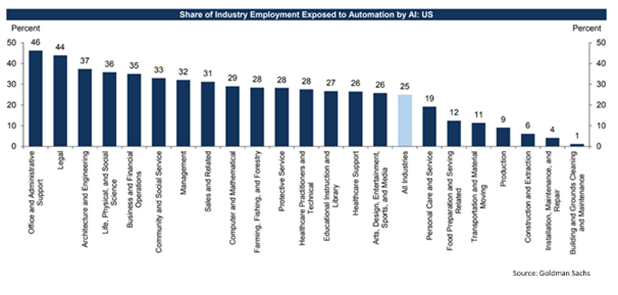

What is the size and scope of $1T in cost savings? By some estimates, there are about 10,000,000 US jobs at stake (16% of their workforce), which could result in an unemployment rate increase of over 6% (US unemployment rate is currently just over 4%). Is 10% the new normal? Can we have jobless economic growth? If you have a highly repetitive job with limited judgements being made, your job is at risk.

The chart above shows us the other probable scenario – companies may just stop hiring. Rather than lay-offs, corporations will stop hiring and allow their employees to retire out.

Dario Amodei, the CEO of AI innovation company, Anthropic warned that AI could wipe out half of all entry-level white collar jobs over the next 1 to 5 years. He went on to say that job losses are coming in technology, finance, law, consulting and other entry level gigs.

However, job losses to date cannot be blamed entirely on AI. A Yale study showed that the layoffs we’ve seen since 2022 were more a result of rising interest rates (to fight inflation). Higher interest rates slowed investment, reduced spending, and halted hiring. The sectors impacted were largely non-AI-replaceable jobs in construction, mining and manufacturing.

Further - a Goldman Sachs survey of investment bankers and their clients found that 11% use AI to reduce headcount (cost savings), while nearly half were using AI to boost revenue and productivity.

A Stanford study says that a shift has started. Entry‑level workers in the most AI‑exposed jobs are seeing clear employment drops, while older peers and less‑exposed roles keep growing.

Of course, if revenues, cost savings or productivity gains don’t materialize fast enough, we might just begin to have the market question the extreme valuations placed on the Magnificent 7. This could also slow the much-hyped private equity unicorns waiting for their Initial Public Offering valuation coronations.

In the long run, AI will create high-paying replacement jobs. The problem is what may happen in the short term, and what happens in between.