David Ricciardelli

December 06, 2021

Financial literacy Economy In the news NewsOmicron, Inflation, and Powell are the Grinches that stole our Santa Clause Rally

Market volatility has picked up over the last two weeks. We have seen a selloff in tech, inflation, and pandemic stock darlings. We usually look forward to a ‘Santa Clause Rally’ this time of year, but it feels like we’re going to see a few more weeks of choppy markets as investors digest the uncertainty caused by the COVID-19 Omicron variant, inflation, and a more hawkish sounding US Federal Reserve (Fed). One of my favorite Wall Street adages is that “Markets stop panicking when Central Bankers start panicking.” The saying is likely to apply to this market. Central Bankers aren’t panicking (yet).

COVID-19 Omicron

Omicron sounds like the name of a robot villain from an action movie, which likely doesn’t help. The most consistent writing that I’ve seen about Omicron is that we need more time to understand the variant and its potential impact. However, once we agree that we need more time to understand the virus, the messaging quickly gets bifurcated. The media is adept at scaring us, and I’ve seen ‘boots on the ground’ commentary from hedge funds that talk about infection and hospitalization, even among the vaccinated, rising quickly. Positively, the ‘boots on the ground’ commentary also highlights that the symptoms are milder and hospital stays are shorter than other COVID variants; the assertion of milder symptoms is constent with a weekend Bloomberg article. We have heard Pfizer and Moderna tell us that their vaccines may or may not be effective against Omicron and that it’ll take about 100 days for a new Omicron vaccine to be available.

Each of these groups could be talking their own book, that is, saying things that benefit their economic interest. Interestingly, JP Morgan Strategist Marko Kolanovic has argued that if the dominant COVID variant is highly infectious with mild symptoms, the deadly pandemic could evolve to something similar to the seasonal flu. He may be talking up his book as well. Only time will tell.

Seasonality and Silver Linings

One silver lining for this market is seasonality. December has historically been the strongest month of the year for the S&P500. Since 1936, December has been a positive month for the S&P500 79% of the time, with an average return of +2.3%. However, this year’s setup feels more like 2018 when a hawkish Fed and growth concerns translated into a 7.6% pullback in December. Markets have had a solid year, so a pause into yearend isn’t unexpected.

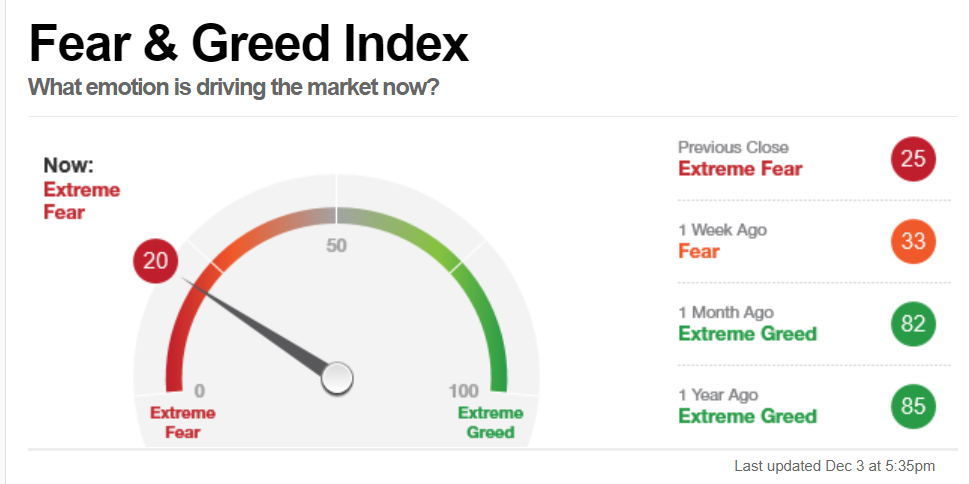

Another positive sign for this market is how quickly the CNN Fear & Greed Index has moved from Extreme Greed to Extreme Fear. Markets don’t usually crash when investors are fearful.

Inflation, Interest Rates, and the Fed

Fed Chair Powell’s comments about accelerating tapering and retiring the word ‘transitory’ indicate that the Fed’s focus has shifted from employment to inflation. We’ve written about inflation extensively over the last year (here, here) with the view that with the exceptions of working capital, increased redundancy, and higher labor costs, most of the inflation we are currently experiencing is transitory. Initially, we were nervous that our view was consistent with central bankers. The Fed retiring the word ‘transitory’ last week is positive. Central Bankers throwing in the towel leads us to believe we’re nearing the crescendo of this inflationary cycle and it’ll be evident in the coming quarters that most of the inflation we’ve seen is actually transitory.

Interesting Charts

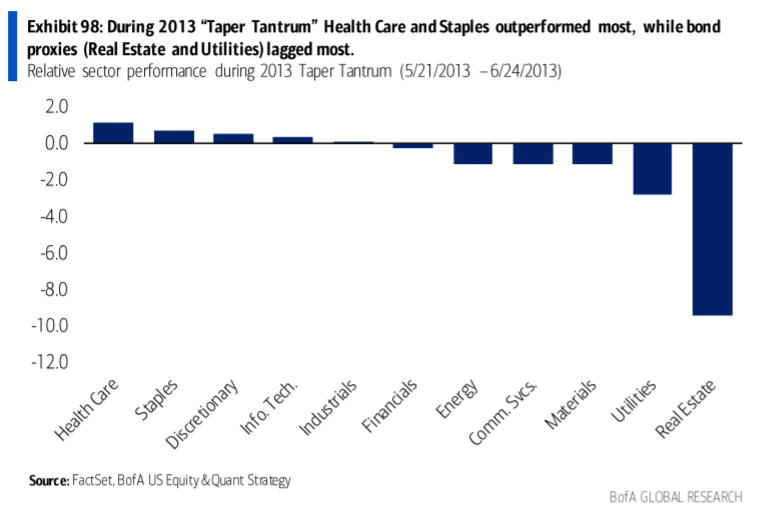

While the market took the Fed’s initial comments about tapering in stride, Powell’s remarks about an accelerating tapper got the market’s attention. While we are not in tantrum territory (yet), the chart below shows the relative performance of GICs sector during the 2013 tapper tantrum. Markets have a knack for bending Central Bankers to their will, so we’ll watch closely to determine who is panicking, the market or the central bankers.

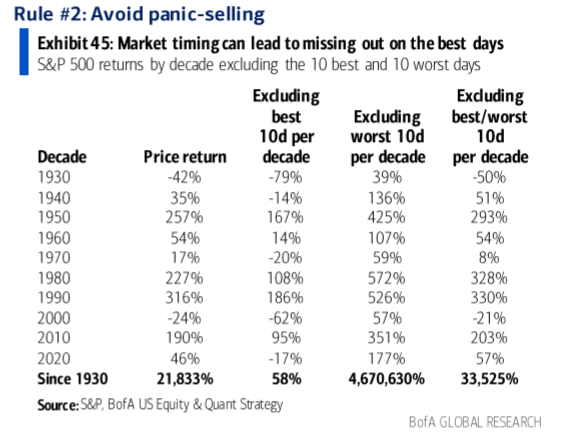

Timing the market is difficult and the chart below does an excellent job of illustrating how devastating it would be to your returns if you weren’t invested for the 10 best days of each decade; since 1930 your total return would be 58% vs 21,833%. While your returns are significantly improved if you miss the 10 worst days of each decade (4,670,630% vs 21,833%), the rub is that the best and worst days in the market are usually quite close together. As we’ve often written, time in the market is important, and investors need to focus on both their time horizon and returns.

Finally, I thought the right side of the chart below does an excellent job of illustrating how much of this year’s stock performance has been driven by earnings revision and multiple expansion. We often hear that the market is expensive, but less time is spent on what’s driving the market’s valuation. Positive earnings revisions are compressing valuations for many sectors.

What’s an investor to do?

I continue to recommend investors pursue a barbell strategy where high-quality companies exposed to secular themes provide exposure to equity markets, while cash and alternative investments reduce volatility and provide ballast for portfolios. Volatile markets are psychologically painful, and having a diversified portfolio can make it easier to weather these inevitable storms.

Over the longer term, investors can reduce the need for market timing and ‘hero market calls’ by saving and investing using a regular cadence, like putting a portion of your earnings aside every week or every month. By saving and investing at a consistent rhythm across market cycles, an investor will end up buying more securities when the market is inexpensive and fewer securities when the market is expensive.

Let me know if you’d like to have a more involved discussion.

Delli 416-594-8990

Disclaimers:

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2021.

Commissions, trailing commissions, management fees, and expenses may all be associated with hedge fund investments. Hedge funds may be sold by Prospectus to the general public, but more often are sold by Offering Memorandum to those investors who meet certain eligibility or minimum purchase requirements. An Offering Memorandum is not required in some jurisdictions. The Prospectus or Offering Memorandum contains important information about hedge funds - you should obtain a copy and read it before making an investment decision. Hedge funds are not guaranteed. Their value changes frequently, and past performance may not be repeated. Hedge funds are for sophisticated investors only.