David Ricciardelli

March 22, 2021

Money Financial literacy EconomyCan equity markets go higher?

When I see the media and pundits forming a clear consensus, like the market’s future direction, I feel compelled to think through the other side of the argument. After all, it is tough to argue that an investor can make money betting with the consensus because, by definition, the consensus opinion should be priced into the market. When the consensus is correct, it is often because the real world was better or worse than they expected.

Similar to June of last year when I wrote This market is BANANAS! B-A-N-A-N-A-S! A Bull Market Thesis, it feels like prophecies of an imminent crash have reached another crescendo. Could markets continue to march higher? Is the pain trade still up?

What would your prediction have been?

A thought experiment that I use to put markets in context is to imagine a point in the past and think about the returns that I would have forecast for the market if I knew what would happen. Let’s give it a try right now. Imagine that you’re back in December of 2019. The S&P500 is trading at 17x forward earnings, not inexpensive but only two turns above the long term average of 15x. The biggest concerns were the US election and a trade war with China. Now from your vantage point in December 2019, how much do you expect the S&P500 to appreciate in 2020 and 2021 if:

- We had a blue wave in the US with the Democrats winning the Presidency, House, and Senate;

- A trade war with China appears less likely;

- We pulled forward technology innovation and adoption by at least two years;

- Monetary and fiscal policy is expected to remain accommodative; and

- Both earnings growth for the S&P500 and US GDP growth will be the highest we’ve seen in years.

When I do this experiment, I think that two or three years of 10-15%+ total returns for the S&P500 seem reasonable. If you’re keeping score at home, the S&P500’s total return in 2020 was 18.4%, and the index has increased 4.6% YTD in 2021. How do these numbers compare with your guesses?

Admittedly the S&P500 valuation does look stretched today at 22x forward earnings. Still, we have to remember that markets are forward-looking, and the earnings growth needed to recover from pandemic lows for many industries will help compress valuation. If companies can grow fast enough, we can compress the S&P500s valuation without the index trading lower.

How long can the Fed remain accommodative?

Admittedly most folks who advocate caution are quick to point out how accommodative fiscal and monetary policy are right now. For the Fed, the current environment is a bit of a panacea. The Fed was concerned about the valuation of growth stocks, and without lifting a finger, the bond market started to increase interest rates in the belly and tail of the yield curve. Growth stocks are very sensitive to discount rates five-plus years in the future, so the bond market took the wind out of the sails of more growth-oriented companies for the Fed. Note this doesn’t change who wins; it simply changes what the winners are worth. The bottom line is the Fed can remain accommodative for longer when the bond market is doing its work for it.

Do markets crash in the spring or summer?

I’m surprised at how rarely it’s brought up, but other than the Dot Com Bubble, the US stock market rarely crashes in the spring or summer. The table below from Visual Capitalist is from August of 2020 and highlights when market crashes have occurred since 1920. I don’t have an explanation for this phenomenon; it may be something as primal as humans tend to be more optimistic when the weather is improving and days are longer.

S&P500 Market Crashes

If you’d like to see this phenomenon in more detail, I’d encourage you to look at page four of Yardeni Research’s S&P500 Correction and Bear Markets Since 1920 report.

Analogies

Last year we highlighted that the 2009 analogy seemed to be the only chart that mattered.

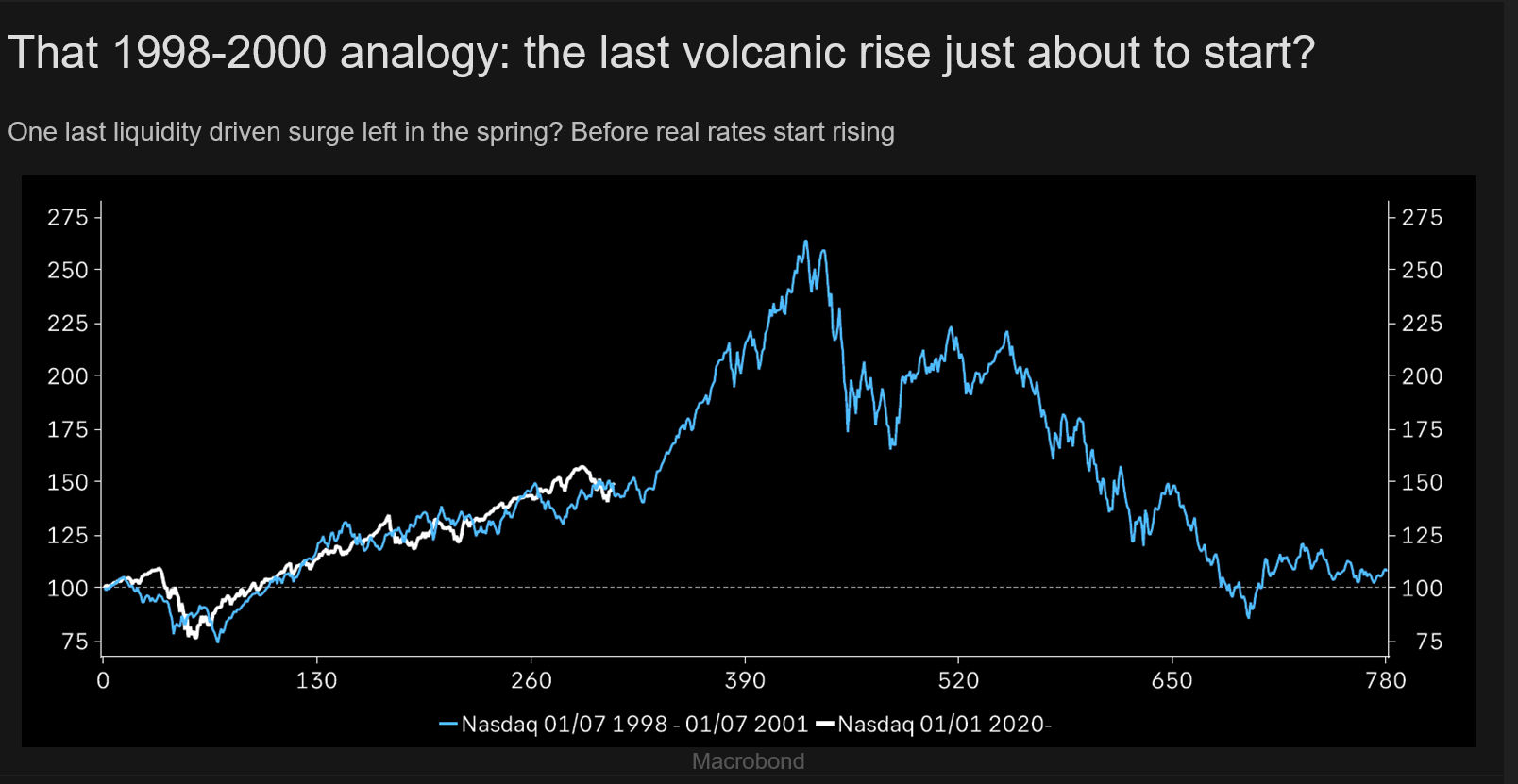

Could 1998-2000 be the appropriate reference point for this year (see below)? If so, it implies another 100% upside before a substantial correction.

What’s an investor to do?

At the risk of sounding like a broken record, I continue to recommend a barbell strategy where high-quality companies exposed to secular themes provide exposure to equity markets. At the same time, fixed income, cash, and alternative investments reduce volatility and provide ballast for portfolios.

Over the longer term, a more practical approach for investors that reduces the need for market timing and ‘hero market calls’ would be to save and invest using a regular cadence, like putting a portion of your earnings aside every week or every month. By saving and investing at a consistent rhythm across market cycles, an investor will end up buying more securities when the market is inexpensive and fewer securities when the market is expensive.

Please contact me for a more detailed discussion.

Delli (delli@cibc.com)

Disclaimers:

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2021.

Commissions, trailing commissions, management fees, and expenses may all be associated with hedge fund investments. Hedge funds may be sold by Prospectus to the general public, but more often are sold by Offering Memorandum to those investors who meet certain eligibility or minimum purchase requirements. An Offering Memorandum is not required in some jurisdictions. The Prospectus or Offering Memorandum contains important information about hedge funds - you should obtain a copy and read it before making an investment decision. Hedge funds are not guaranteed. Their value changes frequently, and past performance may not be repeated. Hedge funds are for sophisticated investors only.