David Ricciardelli

June 17, 2024

Money EconomyNow What? A look at 2H’24

In Turing the Page on 2023, we argued that from a historical perspective the market setup for 2024 looked favorable. After the first quarter, in Is this Market Ahead of Itself? we highlighted that while parts of the market looked frothy, the market lacked the characteristics typically associated with bubbles and had pockets of opportunity. With half of 2024 in the books, we are back with reflections and charts intended to put the current market in context.

Fundamentals Returning as a Focus

Since inflation started to tick higher in 2022, macroeconomics has dominated investor sentiment and has had a major influence on market direction. After years of client calls that were dominated by discussions about inflation (CPI and PCE), the labour market (payrolls and employment), how central bankers would react to the economic data (rate hikes or cuts), and how markets would respond to all the above information, fundamentals (valuation, revenues, earnings, margins, …) have started to creep back into our discussions with clients. Positively, it feels like investors are becoming more focused on fundamentals.

Monsters Under the Bed

The most common question we hear from clients is, ‘What are you concerned about?’. After geopolitical risk and a negative exogenous shock, here are our near-term concerns:

- The US Elections. Markets hate uncertainty, and if either of the current US Presidential Candidates are not on the ballot come November, we would expect a market pullback as market participants digest the implications of a new candidate.

- Bond Markets Become Critical of Fiscal Policy. Globally, fiscal policy (government spending) has been quite loose since the Global Financial Crisis and has become even looser since the COVID-19 pandemic. If bond markets become more diligent, we could see larger term premiums (higher interest rates for longer-duration borrowing) that will negatively impact the valuation of securities and assets funded with longer-duration debt.

- The AI Beneficiaries. A small group of AI beneficiaries has powered a significant portion of the market appreciation since October of 2022. Specifically, one company, Nvidia, dominates the sale of chips (GPUs) used to train AI Large Language Models (LLMs). There is a small group of companies (Alphabet, Amazon, Microsoft, Meta, Tesla, …) that purchases most of these chips (Nvidia highlighted that more than 50% of data centre revenues for 2Q’24 was to cloud service providers) that are responsible to finding profitable ways to monetize their spending on GPUs. If profitability does not materialize as quickly as expected, we could see capital spending and valuations take a breather, like during the Tech Wreck of the early 2000s when Cisco and Nortel provided enterprises with the network equipment to enable eCommerce. (Note: The CIBC Marketing, Compliance and Risk would likely appreciate me explicitly saying that this is not a solicitation nor a recommendation to purchase or sell any of the securities referenced in this paragraph).

Some Charts

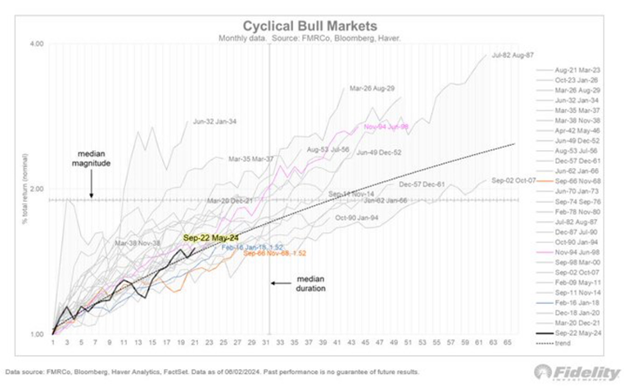

How long can the AI beneficiaries continue to run? It is a tricky question. In Is this Market Ahead of Itself? we suggested that 2023/24 could be similar to 1982/83, but an argument can be made that 1995 is the appropriate comparator. In 1995, we got a soft landing, 75bps of rate cuts, and the S&P 500 made 77 All-Time Highs (we have 29 in 2024 YTD).

When sentiment is stuck in the middle, markets tend to muddle higher.

BofA Sell Side Indicator

CNN Fear & Greed Indicator

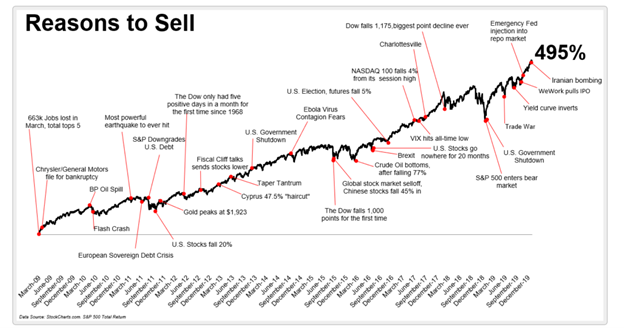

There is always a reason to sell. The challenge is that these situations are often buying opportunities.

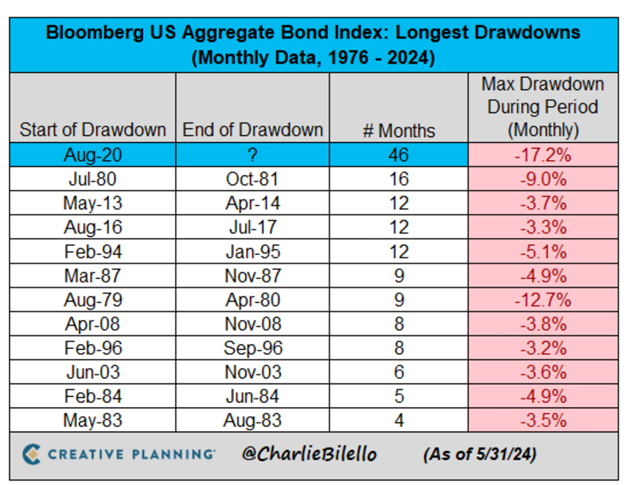

We are living through the longest bond bear market in history.

But, the equity bull market is relatively young.

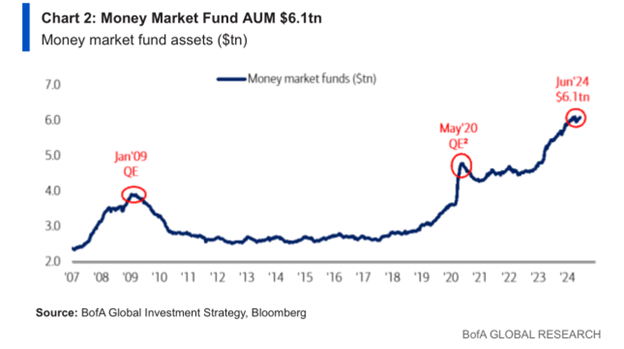

There is also a mountain of money on the sidelines that can be invested.

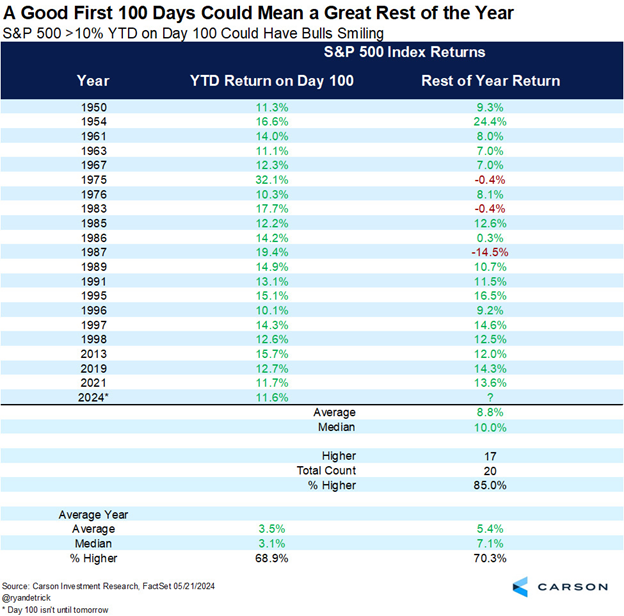

Finally, in the data mining category, markets tend to do well in the fourth year of the US Presidential cycle, especially if they are up more than 10% in the first 100-days of the year.

What’s an Investor To Do?

A sea of conflicting data points is common in investing. As a result, we recommend that investors save and invest consistently across market cycles. With this approach, an investor will buy more securities when the market is inexpensive and fewer securities when the market is expensive. Most importantly, avoid the need to make ‘hero calls’ based on market timing.

We recommend a barbell strategy where high-quality companies exposed to secular themes are used to provide exposure to equity markets. The other side of the barbell is cash, actively managed fixed income and alternative investments that reduce volatility and provide ballast for portfolios. For investors in the distribution phase of their lives, the focus expands to optimize the tax efficiency of distributions.

Please get in touch with me for a more detailed discussion.

Delli (delli@cibc.com)

Disclaimers:

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2024.

Commissions, trailing commissions, management fees, and expenses may all be associated with hedge fund investments. Hedge funds may be sold by Prospectus to the general public, but more often are sold by Offering Memorandum to those investors who meet certain eligibility or minimum purchase requirements. An Offering Memorandum is not required in some jurisdictions. The Prospectus or Offering Memorandum contains important information about hedge funds - you should obtain a copy and read it before making an investment decision. Hedge funds are not guaranteed. Their value changes frequently, and past performance may not be repeated. Hedge funds are for sophisticated investors only.

If you are currently a CIBC Wood Gundy client, please get in touch with your Investment Advisor.