David Ricciardelli

December 17, 2025

Money Financial literacy Economy Commentary2026

We share the view of investors like Buffett, Munger, and Marks that the actual value of a forecast lies not in its accuracy, but in the analytical rigor and scenario planning required to create it. Analyzing the flood of year-ahead research published between Thanksgiving and January helps us identify consensus views and determine what is already priced into the market.

Reflecting on 2025

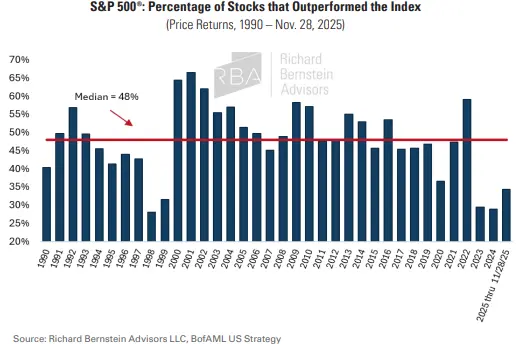

Before we tackle 2026, let's reflect on the wild ride that was 2025. (I'll wait here if you want to peek at our 2025 Year Ahead Note). Despite a 19% drawdown at the April trough, slightly larger than the 16% average annual drawdown since 1928, the S&P 500, in USD terms, is up about 15% for the year and has made 33 new all-time highs. The biggest surprises of 2025:

- The weakness of the USD (a strong USD was the most consensus call in last year's Year Ahead reports),

- The inflationary impact of tariffs on the US economy has been more muted than feared,

- US economic growth displayed remarkable resilience,

- The S&P 500 became even more concentrated (the chart below illustrates how few companies outperformed in the index for the third consecutive year), and

- The S&P 500 delivered robust double-digit earnings growth.

Red Meat for the Bears

Heading into 2026, bearish investors will focus on:

- The current emphasis on AI, and the outperformance of SPACs and Meme Stocks relative to stocks that score well on quality factors.

- Near record low spreads in fixed income markets.

- A softening labor market.

- Retail investors focus on cryptocurrencies, leveraged ETFs and (daily) options.

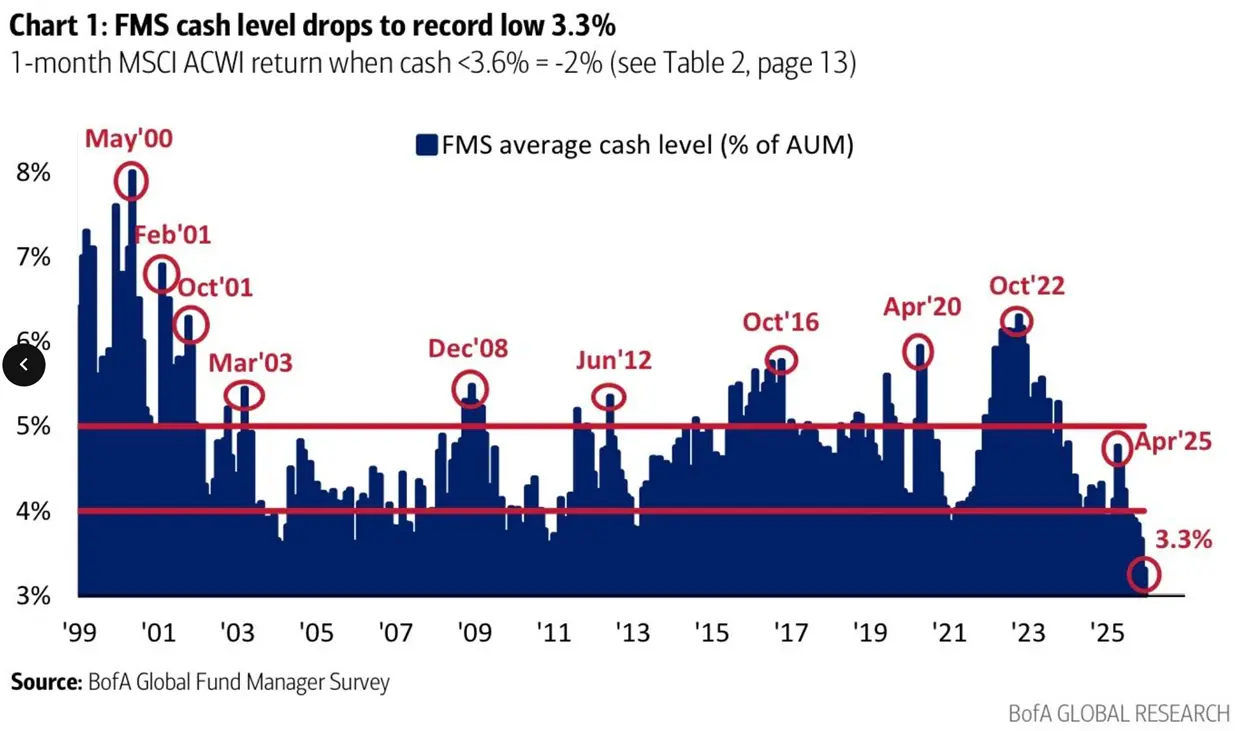

- Cash balances for institutional investors are near a multi-year low.

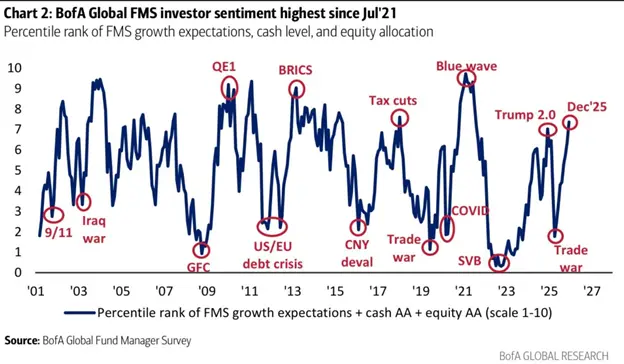

- Investor sentiment is near bullish extremes.

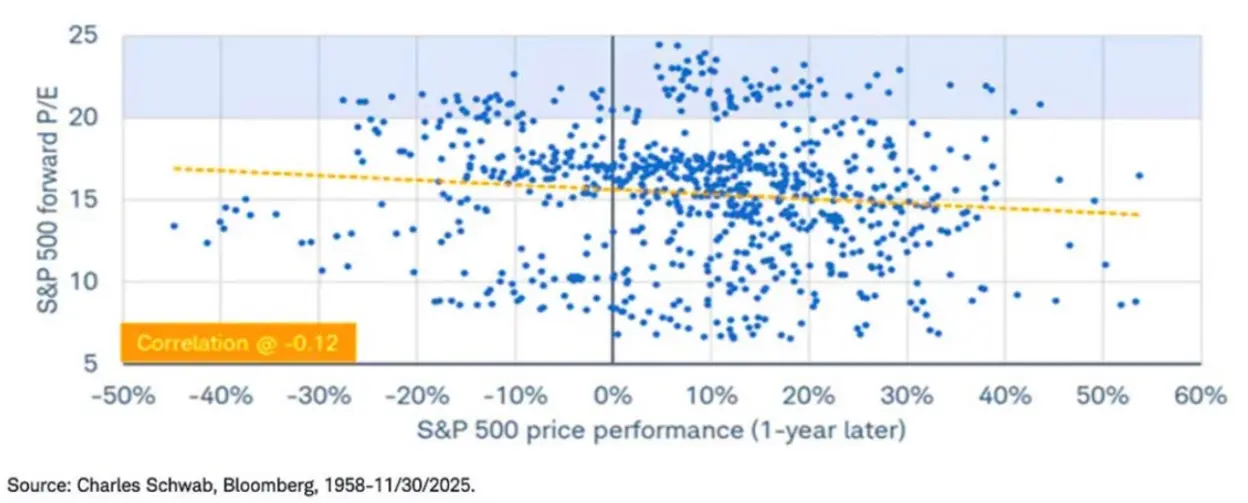

What about Valuation

Bears will also focus on valuation while ignoring the S&P 500's earnings growth, which was the largest positive surprise of 2025. While many pundits continue to warn us about how expensive the market has become, the forward price-to-earnings multiple for the S&P 500 is essentially unchanged from 22.03x last January to 22.02x today. On a relative basis, a 22x forward P/E is expensive. It's almost 2 standard deviations above the 10-year average of 18.1x, but valuation is a terrible market-timing tool, as the chart below illustrates.

S&P 500 Valuation vs One-Year Forward Return

It's a busy chart, but it shows that the S&P 500 delivered returns of about -25% to +40% over the next twelve months, when the Forward Price-to-Earnings Ratio was above 20x. This chart is another reason for investors to stay diversified and invested.

What's Consensus for 2026

From the year-ahead research we've poured over, the most-consensus call for 2026 is that the S&P 500 will once again deliver 10%+ earnings growth. This growth is driven by AI and broad-based capital spending as corporations take advantage of accelerated depreciation under the One Big Beautiful Bill Act (OBBBA; we're clearly running out of acronyms).

After S&P 500 earnings growth, the strategist starts to diverge from price targets for the S&P 500, which range from 7,000 (+3%) to 8,000 (+18%), driven by multiple contraction (a smaller price-to-earnings multiple) vs. a consistent multiple; no one is looking for any significant multiple expansion.

Almost every report discusses a K-shaped economy, meaning the wealthy are benefitting from asset price appreciation (the upward sloping part of the letter 'K'), while the mass affluent (read the less wealthy individuals) struggle with a weakening labor market and affordability (the downward sloping part of the letter 'K').

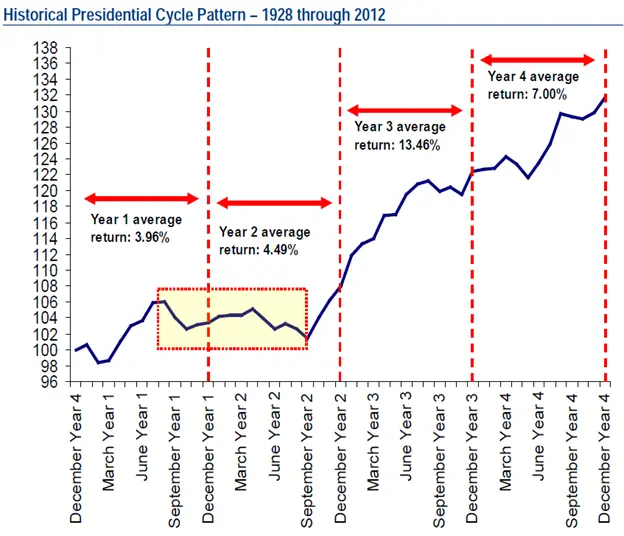

Some strategists point out that the second year of the US Presidential Cycle, when mid-term elections occur, tends to be a softer year for markets.

(Source: Seeking Alpha)

What about Canada

I recently had a conversation with a friend and former colleague, a strategist for a global brokerage, that resonated with me. He highlighted:

- The USMCA will be renegotiated in 2026. The resolution could yield a positive surprise, but more importantly, it will reduce uncertainty and enable companies to make capital-spending decisions.

- The government appears to be taking a more pragmatic approach to our energy sector and skills-based immigration.

- Accelerated depreciation should have a positive impact, as it does in the US.

- Rate resets have nearly run their course and may become a catalyst for both commercial and residential real estate sectors.

The thesis here is that things have gotten so bad that it doesn't take much to bounce off the bottom and see a significant sequential improvement!

What about AI

We shared our thoughts on the implications of AI for markets in AI Bust or AI Boom. My conclusion was that if AI is a general-purpose technology, it could power earnings growth across the entire economy, and we could see the stock market rally as earnings propel the market higher while valuations compress to more 'normal' levels. It's going to be tough to stick the landing as expectations can get years ahead of reality, but I want to include a few charts to put AI capital spending in context with past bubbles.

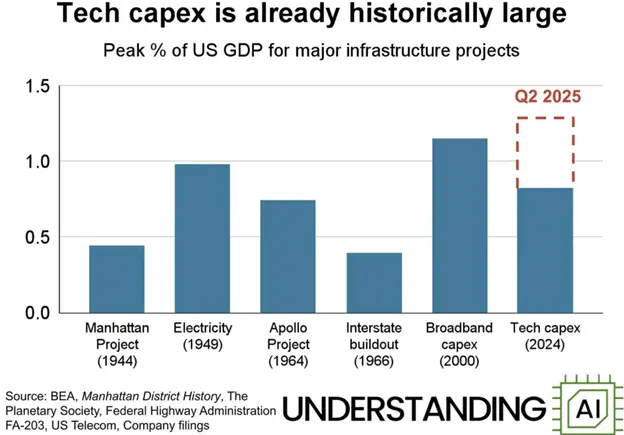

Technology capex already accounts for a relatively large share of US GDP.

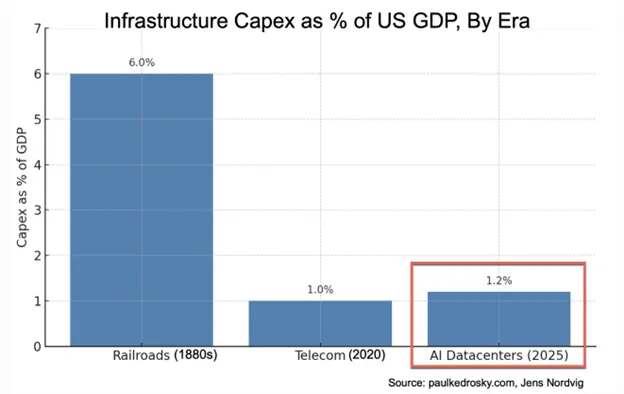

But it pales in comparison to the capital spent on railroads in the 1880s, and reminds us that situations can persist for much longer than most people expect.

In case you are interested, Ben Thompson from Strachery wrote an interesting post called The Benefits of Bubbles discussing how the US's ability to fund bubbles and build infrastructure is one of the country's competitive advantages.

What's an investor to do?

The key for investors is often to stay invested and diversified. There are always reasons to sell, but you will not find many investors happy about selling in 2018, 2020, 2022, or in early 2025, when the market was down 19%. In 2025, the key (again) was to stay invested.

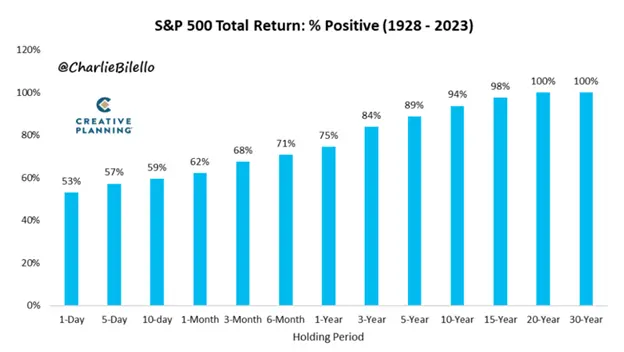

The chart below illustrates that longer time horizons increase the probability of a positive return for the S&P 500.

While action helps alleviate anxiety, timing markets is extremely difficult. Investors will benefit from saving and investing consistently across market cycles. This process allows investors to buy more securities when the market is inexpensive and fewer securities when the market is expensive. Consistently investing across market cycles also provides investors with fresh capital to exploit emerging structural changes.

Some investors may find value in a barbell strategy, where high-quality companies exposed to secular themes provide equity market exposure. The other side of the barbell is cash, actively managed fixed income and alternative investments that may reduce volatility and provide ballast for portfolios. For investors in the distribution phase of their lives, the focus expands to optimize the tax efficiency of distributions.

Don't hesitate to get in touch with me for a more detailed discussion.

Delli (delli@cibc.com)

Disclaimers:

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2025.

Commissions, trailing commissions, management fees, and expenses may all be associated with hedge fund investments. Hedge funds may be sold by Prospectus to the general public, but more often are sold by Offering Memorandum to those investors who meet certain eligibility or minimum purchase requirements. An Offering Memorandum is not required in some jurisdictions. The Prospectus or Offering Memorandum contains important information about hedge funds - you should obtain a copy and read it before making an investment decision. Hedge funds are not guaranteed. Their value changes frequently, and past performance may not be repeated. Hedge funds are for sophisticated investors only.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.