David Ricciardelli

February 16, 2026

Economy CommentarySoftware eats the World, but AI eats Software and Everything Else!

The last few weeks have been odd. We have had many inbound inquiries from clients asking about how we are going to reposition their portfolios. What makes these inquiries unusual is that we generally don’t get this volume of inbound inquiries when the S&P500 is less than 3% off its all-time highs and down about 1% for the year. As usual, we will reiterate that we don’t try to predict what markets will do in the short term, but we will try to put the current market in context.

The Economy Looks Surprisingly Strong

The risks are everything that you are reading about in the media (AI, AI Capex, geopolitics, debt, trade, sociopolitical unrest, …) but the US economy looks strong. Here is a small collection of charts looking at earnings and the US economy.

Earnings have been incredibly robust. As of Thursday, February 12th, 350 S&P 500 companies have reported 4Q results with sales and earnings up 9.0% and 12.4% YoY, respectively. Remember we are comping against 10%+ earnings growth in 2024; that’s a 20%+ two-year stack with accelerated depreciation and consumer spending from tax refunds from the One Big Beautiful Bill Act (OBBBA) on the horizon.

GDP growth is robust. We could see a slowdown in 4Q because of the government shutdown, which could reduce GDP by 1.5-2.5% because the salary paid to government employees is part of GDP. Regardless, the largest economy in the world is growing faster than it has for most of the last two decades.

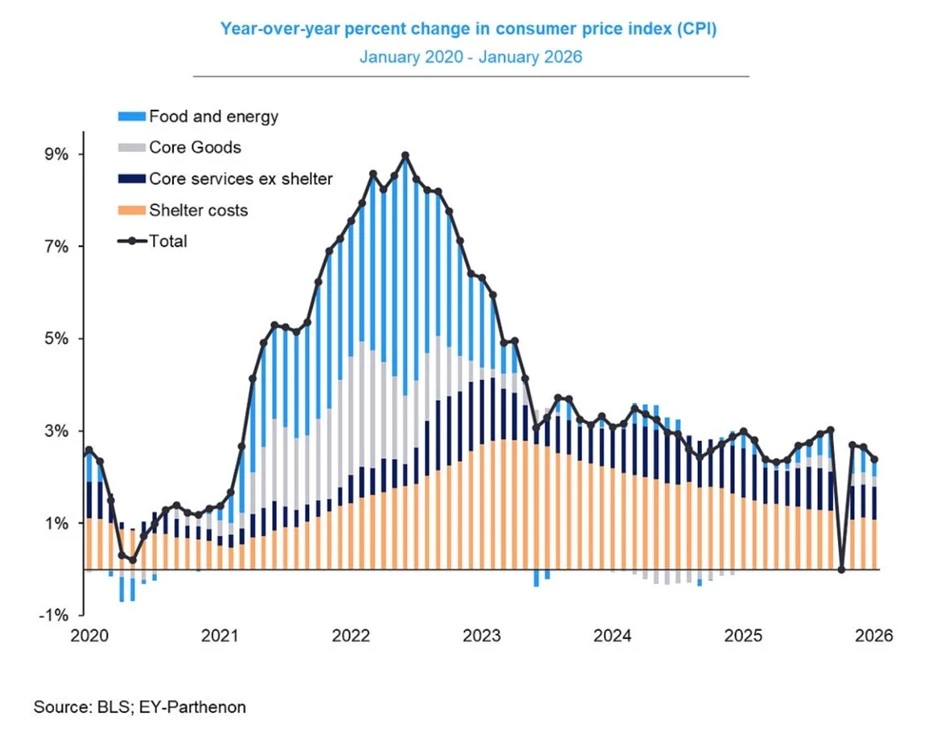

US inflation continues to cool, and lower tariffs should compliment this trend.

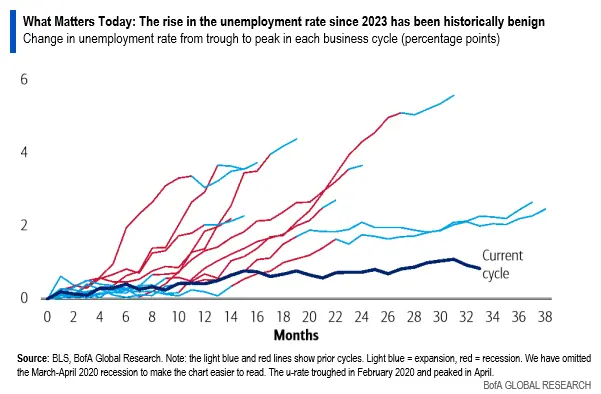

US employment has been slowing but remains strong. In fact, when unemployment troughs, like it did in April of 2023, we usually get a recession in less than fourteen months, and we exit the recession in less than twenty-seven months. It has been 30+ months, and a US recession does not look imminent.

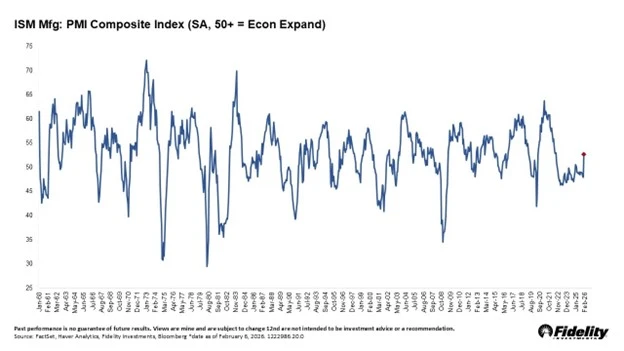

US manufacturing is accelerating. The ISM (Institute for Supply Management) Manufacturing index is back above 50 and new orders have surged about 20%!

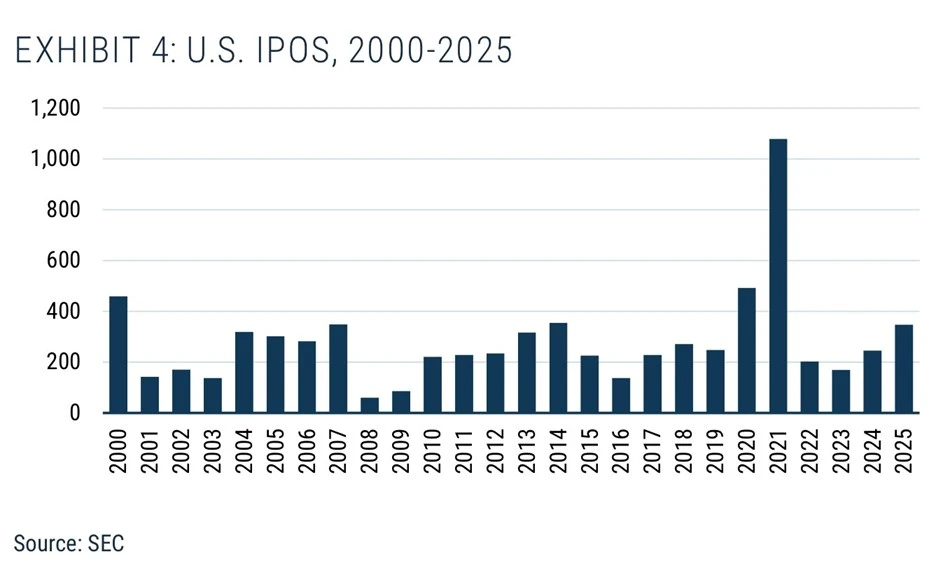

IPOs are accelerating after a three-year lull.

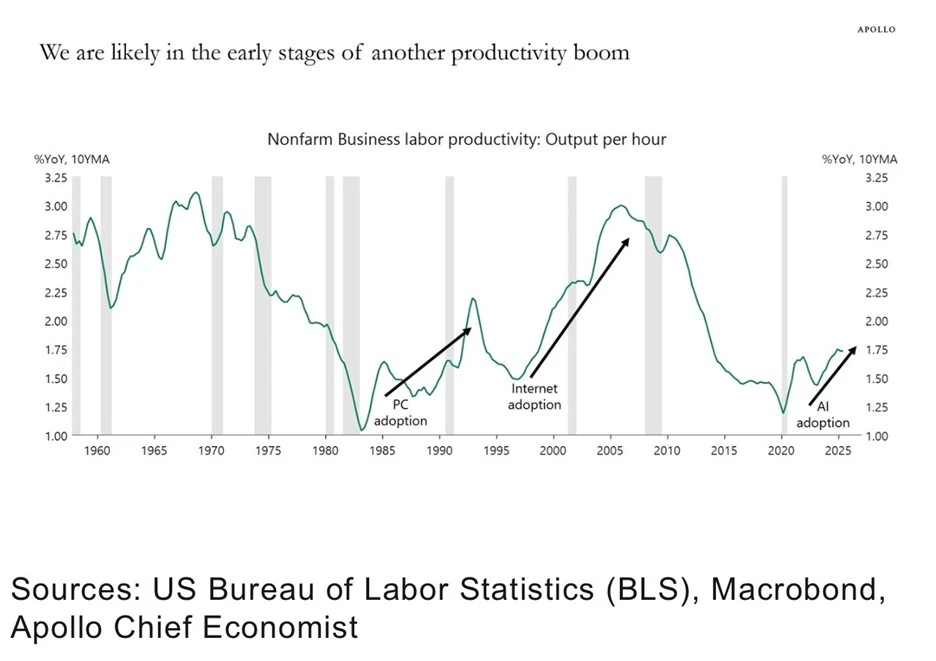

US productivity is also accelerating.

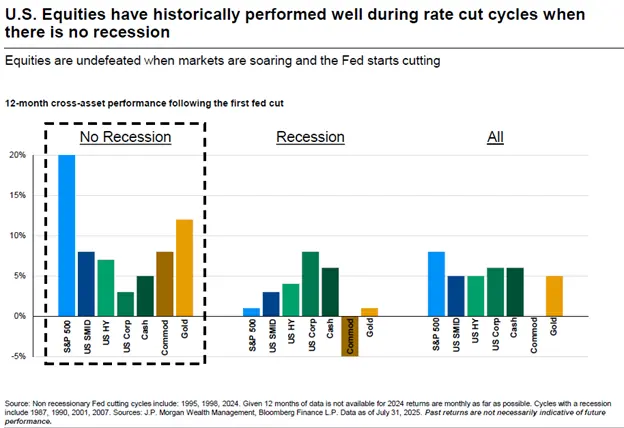

US markets tend to do well when the Fed is cutting interest rates, and we don’t experience a recession.

Software eats the World, but AI eats Software and Everything Else!

The last two weeks have been exhausting. It all started with speculation that AI will be the catalyst for corporations to replace enterprise software by using AI to internally develop and maintain homegrown applications. Dubbed the “SaaSpocalypse”, the thesis continued to evolve over the last week to AI will also replace wealth management, real estate, personal and commercial insurance, legal services, exchanges, and logistics! By the time you read this there will likely be other industries selling off due to the specter of AI obsolescence.

From my perspective, this feels a lot like the AI will destroy search thesis from 18-24 months ago. At the time, we thought that proprietary data would likely be an AI differentiator, and that search and advertising would be a net beneficiary from AI. That thesis appears to have played out consistent with our expectations, but it took time for the market to reconsider its perspective.

Today, the AI vs software thesis seems very similar. There is lots that AI can do and the jury is still out on where the economic rents get captured (we try to tackle this topic in AI Bust or AI Boom), but I find it hard to believe that Fortune 1000 Companies are going to tear out their ERP (Enterprise Resource Planning) or CRM (Customer Relationship Management) systems and replace them with internally developed systems that will be maintained by their internal software developers using AI. I find it even harder to believe that a small business, like a lawn care company, or a pool servicing company, or your local bicycle shop, will be vibe coding and maintaining their own ERP software using AI. These small businesses might start using AI to interact with their customers, but I don’t expect many to be interested in focusing on software developments and maintenance.

I think a more likely scenario, is that VMS (Vertical Market Software) and SaaS (Software as a Service) companies will use AI to develop code, maintain their software, and build new features, and that the economic rents from these activities will be shared between the software developers and their customers. We will iterate faster, new features will be introduced more quickly, and patches will be released more quickly but consumers, vendors, and service providers will share in the benefits.

The biggest challenge here, is like the AI vs Search debate, there is no catalyst that ends the selloff. Investors will likely need to wait for multiple earnings reports for it to become apparent that software (enterprise, SaaS, and VMS), and other industries continue to deliver strong fundamentals and demonstrate that they are sustainable businesses.

This is Nonsense

Where do rates go next? I could not resist. The image implies that interest rates are dependent on the height of a new Fed Chairperson relative to height of the last Fed Chairperson. Unfortunately, the image isn’t correct since Powell is six feet tall and Warsh is an inch taller at six feet and one inch.

Volatility is Price of Equity Market Returns

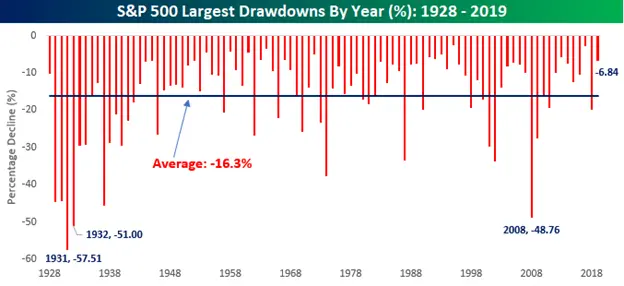

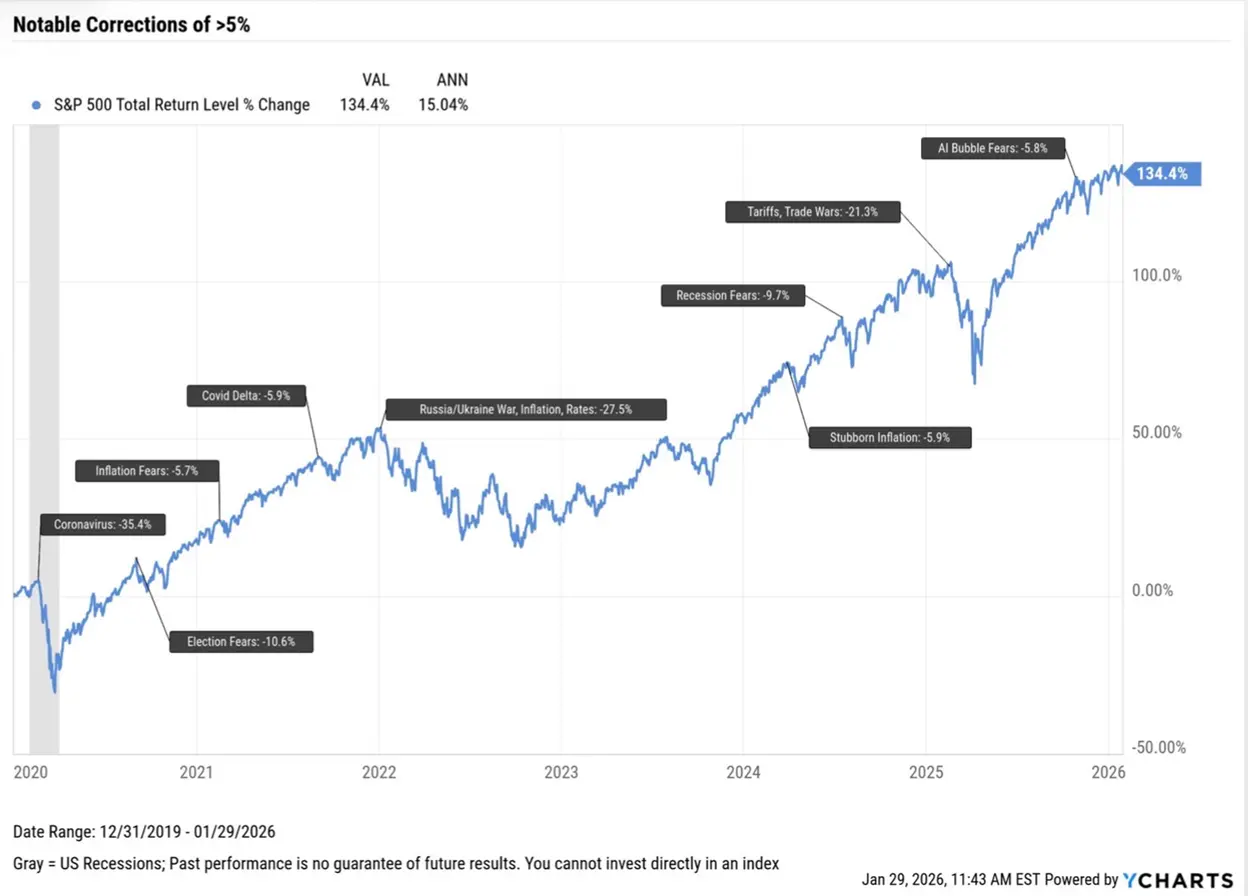

Here are some recycled charts that try to put the current equity market volatility in context.

The average annual peak to trough drawdown for the S&P 500 since 1928 is about 16% and the median is about 13%. The 19% drawdown in 2025, was a little more than average but it would be normal so see a similar drawdown this year or next.

One average, the S&P 500 experiences three to four 5% drawdowns each year for the last 100 years. Choppy markets are normal and being anxious is a normal state for an investor.

What's an investor to do?

The key for investors is often to stay invested and diversified. There are always reasons to sell, but you will not find many investors happy about selling in 2018, 2020, 2022, or in early 2025, when the market was down 19%. In 2025, the key (again) was to stay invested.

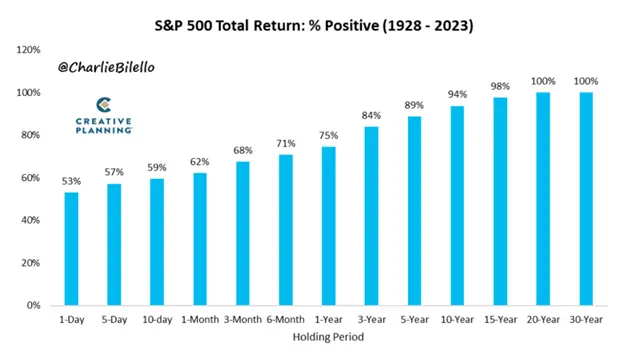

The chart below illustrates that longer time horizons increase the probability of a positive return for the S&P 500.

While action helps alleviate anxiety, timing markets is extremely difficult. Investors will benefit from saving and investing consistently across market cycles. This process allows investors to buy more securities when the market is inexpensive and fewer securities when the market is expensive. Consistently investing across market cycles also provides investors with fresh capital to exploit emerging structural changes.

Some investors may find value in a barbell strategy, where high-quality companies exposed to secular themes provide equity market exposure. The other side of the barbell is cash, actively managed fixed income and alternative investments that may reduce volatility and provide ballast for portfolios. For investors in the distribution phase of their lives, the focus expands to optimize the tax efficiency of distributions.

Don't hesitate to get in touch with me for a more detailed discussion.

Delli (delli@cibc.com)

Disclaimers:

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers, and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and a spread between the bid and ask prices if you purchase, sell, or hold the securities referred to above. © CIBC World Markets Inc. 2026.

Commissions, trailing commissions, management fees, and expenses may all be associated with hedge fund investments. Hedge funds may be sold by Prospectus to the general public, but more often are sold by Offering Memorandum to those investors who meet certain eligibility or minimum purchase requirements. An Offering Memorandum is not required in some jurisdictions. The Prospectus or Offering Memorandum contains important information about hedge funds - you should obtain a copy and read it before making an investment decision. Hedge funds are not guaranteed. Their value changes frequently, and past performance may not be repeated. Hedge funds are for sophisticated investors only.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.