Calvin Tenenhouse and Peter White

October 24, 2025

Q3 2025 Market Update

2025 has been a whirlwind of a year, with market movements, both up and down, driven by the AI boom, geopolitical risks, tariffs, fiscal stimulus and Fed independence concerns. The herd mentality surrounding investing is more blatant than ever. One striking example of this is a firm we will leave unnamed that currently runs four U.S. equity funds with different investment approaches – value, growth, dividend and core. Despite the different fund names and investment approaches, the Mag 6 were the top holdings for all four funds.

It would have been hard to imagine at the start of the year that global stocks—both Emerging Markets and Developed Markets ex-US—would emerge as the best-performing assets through the end of September. The incoming U.S. administration’s explicitly protectionist agenda seemed poised to harm export-oriented economies, which dominate the Emerging Markets, while an expansionist Russia threatened European stability. Yet, 2025 has demonstrated that the risk-dampening benefits of diversification can appear when least expected, as these markets have led the way in a year that has produced positive returns across most asset classes. As the quarter century comes to a close, and excitement surrounding new investment opportunities is about as high as it was in 1999, this blog post shares some insights on where we’ve been and where we’re going.

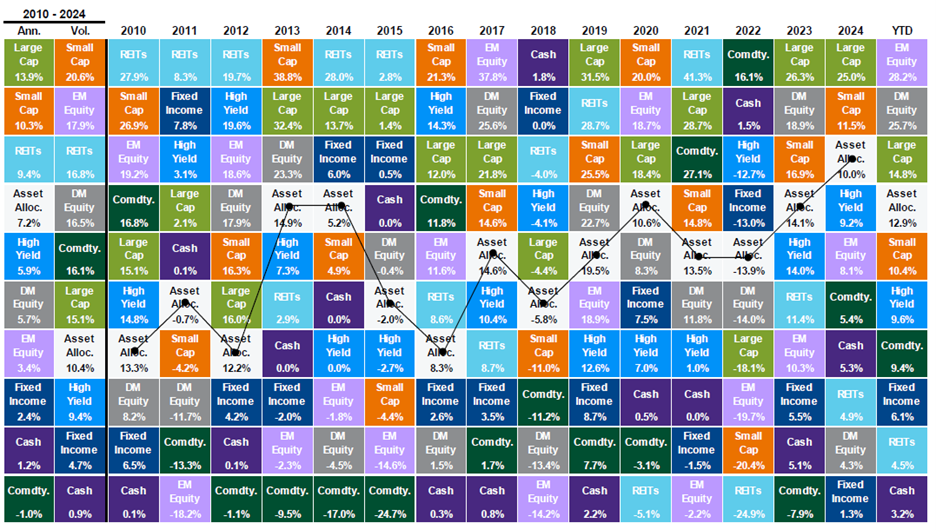

The chart below ranks annual returns by asset class from 2010 through year-to-date 2025. Take a moment to review it and feel free to email us with your observations. Here are a few of ours:

Figure 1 - Source: JP Morgan

- Equities remain dominant for long-term growth: For those willing and able to assume market risk, holding equities continues to be the most effective long-term strategy.

- High volatility, high returns: Asset classes like Small Cap and Emerging Market Equity, which often top the rankings, also experience some of the highest annualized volatility.

- The value of balanced portfolios: Asset allocated (balanced) strategies typically avoid both the highest highs and lowest lows, underscoring the importance of diversification in smoothing returns.

- Market timing is challenging: Predicting next year’s winner based on the previous year’s performance is unreliable.

- The pitfalls of holding cash: Holding cash resulted in the lowest returns in 6 of the past 15 years. As the saying goes, “The best time to plant a tree (or start investing) was 15 years ago; the second-best time is now.”

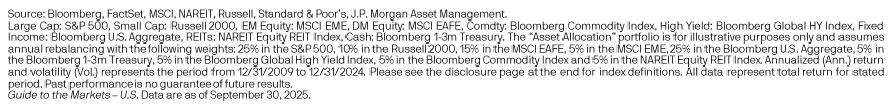

Could the bull market run forever?

Well probably not forever. But the graphic below does provide some insight on how far we can go. Here are the takeaways.

- Periods of economic growth are not only more frequent but also much longer in duration than downturns. This “asymmetry” is a fundamental reason why long-term investors tend to be rewarded for staying invested.

- The average Bull Market Run has lasted 70 months, with the bull run following the global financial crisis lasting nearly double that. We are currently in month 34.

- Bull Markets last longer than economic expansions, often ending in a period of overvaluation.

Figure 2 - Source JP Morgan

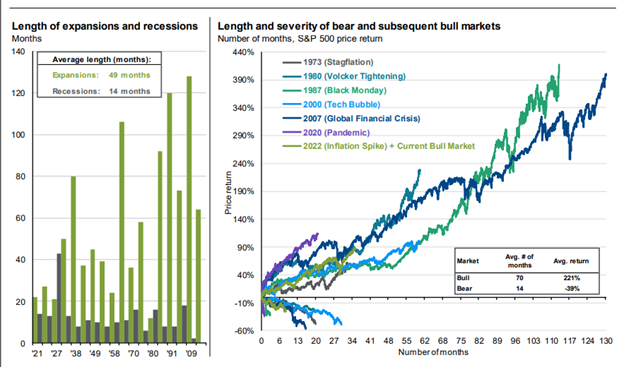

The end of U.S. Exceptionalism?

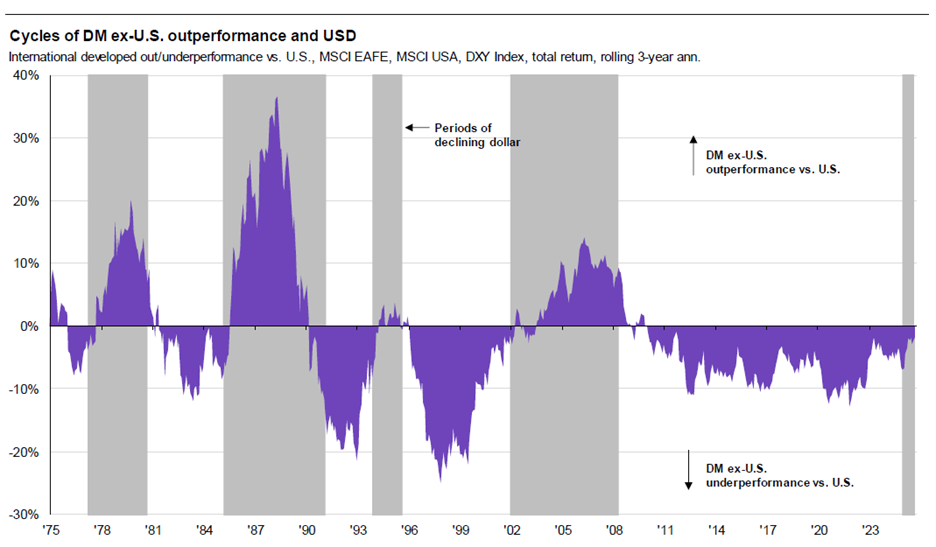

If the late 1990s parallels hold, then the natural corollary is a sustained period of weakness in the USD$. There is growing evidence that the current boom in the U.S. could be followed by a period of sustained U.S. dollar weakness:

- Tariffs and an explicit desire by the White House to weaken the U.S. dollar have led to the 10% slide in the trade-weighted U.S. dollar year to date.

- A dovish Federal Reserve and rising fiscal deficits from the One Big Beautiful Bill Act will weigh on the dollar going forward.

- With Powell nearing the end of his term, speculation is growing that his successor may suppress rates to manage debt—just as the Federal Reserve did in the 1940s.

- That would mean capped yields and expanded balance sheets regardless of inflation—a debt accommodation playbook.

- This trend benefits:

- International equities

- Gold and Real Assets

- Commodities

Figure 3 - Source JP Morgan

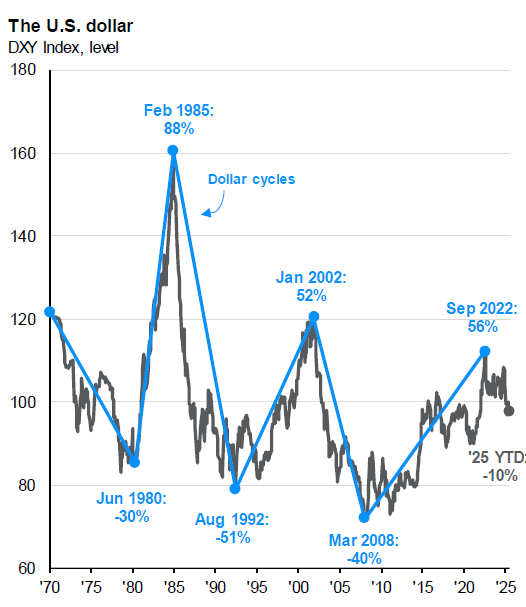

International Equities: Finally Participating

After a sustained period of underperformance vs. their global peers, EAFE stocks are having a moment. There are several fundamental reasons why this could continue.

The MSCI EAFE (Europe, Australasia, and the Far East) index offers:

- A more reasonable valuation than U.S. stocks at 16.5x forward earnings.

- Strong dividend yield + share buybacks are shareholder-friendly – total returns to shareholders have been higher for EAFE stocks than US Stocks since 2020.

- Ongoing structural reform in key economies like Japan, Taiwan and South Korea should support further growth.

- Tariff-driven repositioning of supply chains to more trade-friendly nations could also benefit these regions.

- A weak U.S. Dollar coincides with sustained outperformance in global stocks (ex-U.S.), such as the periods from 1978 – 1981, 1985 – 1990, and 2002 - 2008.

Figure 4 - Source JP Morgan

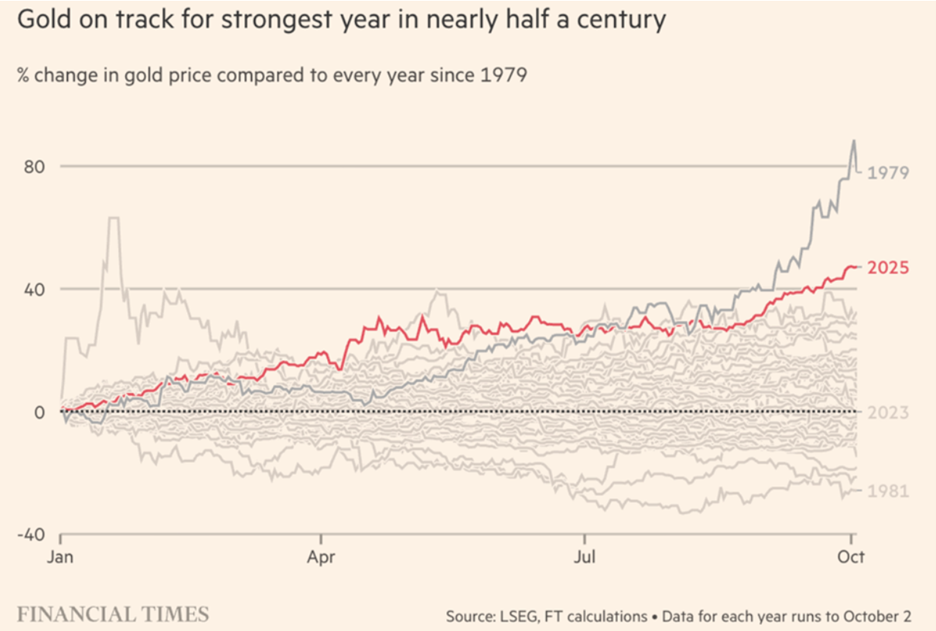

Gold & Real Assets: Responding to Liquidity

Despite a stumble over the past week, gold has had one of its best years in the last 50, as you can see below. This rally is supported by:

- Expanding global money supply

- Real interest rates are trending lower.

- A weakening dollar

- Economic and political uncertainty

Ultimately, investors own gold because of its role as a store of value and an inflation hedge – but is it justified? Claude Erb and Campbell Harvey of Duke University outline the many ways that gold fulfils this role in their seminal NBER paper, The Golden Dilemma, which they recently updated in a paper titled Understanding Gold. It’s worth a read. Fun fact – the entire supply of mined gold in the world would fill an Olympic sized swimming pool, and new supply at 3,300 metric tons in 2024 would only increase supply by 2%.

Figure 5 - Source Financial Times

Final Thoughts

As we look ahead to the remainder of 2025 and beyond, the lessons of diversification, disciplined investing, and global perspective remain as relevant as ever. Navigating these dynamic markets will require both adaptability and a steady focus on long-term objectives. Thank you for reading, and GO JAYS GO!

Charts provided by JP MORGAN: 2025 Guide to the markets